The Apple iPhone is one of the most iconic and influential consumer technologies in history, representing both the technological prowess and brand philosophy of Apple Inc. Since its launch in 2007, the iPhone has redefined communication, triggered paradigm shifts in global markets, and expanded Apple’s reach far beyond the realm of personal computing. This report provides an exhaustive overview of the iPhone’s journey—tracing Apple’s origins, the evolution of every iPhone model to date, key innovations in each release, the major hurdles Apple faced in this pursuit, its global market stance, detailed sales and revenue performance, and a forward-looking assessment of its future strategies. The article closes with thoughtful coverage of Apple’s sustainability and ecosystem expansion efforts, underlining its influence not just as a technology manufacturer, but as a key player in shaping responsible digital futures.

1. History and Background of Apple Inc.

1.1 Founding of Apple Inc.

Apple Inc., originally known as Apple Computer, Inc., was founded on April 1, 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne in Cupertino, California. The primary purpose at inception was to market Wozniak’s Apple I desktop computer, an assembled circuit board designed for hobbyists attending the burgeoning Homebrew Computer Club meetings in Silicon Valley. Jobs, a visionary with keen marketing acumen, recognized the commercial potential after seeing Wozniak demonstrate the device. In classic startup fashion, Jobs financed early production by selling his Volkswagen van, while Wozniak sold his HP-65 calculator.

Ronald Wayne, an administrative overseer, briefly joined as a co-founder, providing business structure, but sold his share back to Jobs and Wozniak just twelve days after the company’s founding, wary from earlier business failures. Mike Markkula, a former Intel executive, bankrolled Apple’s further expansion in 1977 with a pivotal $250,000 investment, cementing Apple’s place among Silicon Valley’s serious competitors.

1.2 Early Products and Evolution

Apple’s early prominence stemmed from the Apple II, released in 1977 and designed by Wozniak. The device was a pathbreaker in bringing color graphics and an open architecture to home computing. Its real mass market impact, however, was catalyzed by the arrival of VisiCalc, the first spreadsheet program, which made the Apple II indispensable to business users and jump-started PC adoption in the business sector. Between 1977 and 1980, Apple’s annual sales swelled from $775,000 to $118 million.

However, subsequent efforts, such as the Apple III and Lisa, faced commercial difficulties due to design flaws and pricing miscalculations. The Lisa is credited as the first personal computer with a graphical user interface (GUI), a concept that would take center stage in future innovations.

1.3 The Macintosh and Brand Renaissance

In 1984, Apple launched the Macintosh, the first mass-produced personal computer with a GUI, mouse, and built-in screen, famously introduced by a blockbuster Super Bowl commercial directed by Ridley Scott. Steve Jobs’ insistence on design and user experience made the Mac a creative industry favorite, even as it initially faced slow adoption and high pricing.

Internal power struggles culminated in Jobs’ departure in 1985, and he subsequently founded NeXT, whose technical innovations later contributed to Apple’s software renaissance. Meanwhile, Apple continued to develop the Macintosh family, becoming a mainstay for creative, educational, and publishing markets, even as Windows-based PCs eroded its market share in the 1990s.

1.4 Return of Steve Jobs and the iPod Era

Apple’s fortunes waned until Jobs returned in 1997 via Apple’s acquisition of NeXT. Jobs radically streamlined the product lineup, rejuvenated Apple’s culture, and initiated the “Think Different” campaign. Major hits like the colorful iMac, iTunes, and the iPod followed, with the iPod’s success—greatly aided by iTunes’ ecosystem—turning Apple into a leader in digital music and content distribution. In 2007, the company dropped “Computer” from its name, marking its full transition into consumer electronics and mobile devices.

1.5 Biographies of the Founders

Steve Jobs

Steve Jobs (1955–2011) was Apple’s visionary co-founder, a charismatic marketer, and a complex leader who transformed several industries—computers, music, movies, phones, and tablets. Jobs’ insistence on end-to-end control shaped Apple’s unique integration of hardware, software, and services. Even after his ouster in 1985, he went on to found NeXT and acquire Pixar, revolutionizing animated film. His return to Apple revived the company and paved the way for revolutionary devices such as the iPod, iPhone, and iPad. Jobs is remembered for his product launch prowess and his mantra: “Skate to where the puck is going to be, not where it has been.”

Steve Wozniak

Steve Wozniak (“Woz”) was the engineering genius behind the early innovations—Apple I and Apple II—and an advocate of democratizing technology. His designs set new standards for usability in early computers. Although Wozniak gradually stepped back from day-to-day operations in the 1980s, his technical contributions and ethos influence Apple’s approach to design and engineering excellence.

Ronald Wayne

Ronald Wayne, the third co-founder, was instrumental in setting up the initial business processes, but left early. His brief role nonetheless provided necessary legal and structural guidance at Apple’s inception.

2. Chronological Overview of All iPhone Models: Specifications and Innovations

Apple’s iPhone lineup has consistently advanced the state of mobile technology, setting benchmarks for design, UI innovation, and technical prowess. Below is a comprehensive tabular overview, followed by an analysis of each era and its major innovations.

2.1 iPhone Model Chronology and Key Specifications

| Model / Year | Display | Camera | Storage Options | Major Innovations/Features |

|---|---|---|---|---|

| iPhone (2007) | 3.5” LCD | 2 MP | 4/8/16 GB | Multi-touch UI, Safari browser, Visual Voicemail |

| iPhone 3G (2008) | 3.5” LCD | 2 MP | 8/16 GB | 3G network, App Store, GPS |

| iPhone 3GS (2009) | 3.5” LCD | 3 MP | 8/16/32 GB | Video recording, speed boost, Voice Control |

| iPhone 4 (2010) | 3.5” Retina | 5 MP | 8/16/32 GB | Retina Display, FaceTime, stainless/glass design |

| iPhone 4S (2011) | 3.5” Retina | 8 MP | 8/16/32/64 GB | Siri, iCloud, improved camera |

| iPhone 5 (2012) | 4” Retina | 8 MP | 16/32/64 GB | LTE, Lightning port, aluminum chassis |

| iPhone 5c (2013) | 4” Retina | 8 MP | 16/32 GB | Colorful plastic design, affordable |

| iPhone 5s (2013) | 4” Retina | 8 MP | 16/32/64 GB | Touch ID, 64-bit processor |

| iPhone 6 / 6 Plus (2014) | 4.7”/5.5” | 8 MP | 16/64/128 GB | Larger screens, Apple Pay, improved sensors |

| iPhone 6s / 6s Plus (2015) | 4.7”/5.5” | 12 MP | 16/32/64/128 GB | 3D Touch, 4K video, Rose Gold color |

| iPhone SE (2016) | 4” Retina | 12 MP | 16/32/64/128 GB | Compact w/ flagship internals |

| iPhone 7 / 7 Plus (2016) | 4.7”/5.5” | 12MP/dual 12MP | 32/128/256 GB | Water resistance, dual camera, no headphone jack |

| iPhone 8 / 8 Plus (2017) | 4.7”/5.5” | 12MP/dual 12MP | 64/128/256 GB | Wireless charging, new glass back design |

| iPhone X (2017) | 5.8” OLED | Dual 12MP | 64/256 GB | Face ID, OLED, no Home button |

| iPhone XS / XS Max (2018) | 5.8”/6.5” | Dual 12MP | 64/256/512 GB | Dual SIM, Smart HDR |

| iPhone XR (2018) | 6.1” LCD | 12 MP | 64/128/256 GB | Affordable flagship, multiple colors |

| iPhone 11 (2019) | 6.1” LCD | Dual 12MP | 64/128/256 GB | Night mode, ultra-wide camera |

| iPhone 11 Pro/Pro Max (2019) | 5.8”/6.5” | Triple 12MP | 64/256/512 GB | Triple camera, OLED, improved battery |

| iPhone SE (2nd Gen, 2020) | 4.7” Retina | 12 MP | 64/128/256 GB | A13 Bionic, affordable upgrade |

| iPhone 12 series (2020) | 5.4”-6.7” | Dual/Triple 12MP | 64/128/256/512 GB | 5G, MagSafe, flat edge design |

| iPhone 13 series (2021) | 5.4”-6.7” | Dual/Triple 12MP | 128/256/512/1TB | Cinematic video, ProMotion 120Hz, battery boost |

| iPhone SE (3rd Gen, 2022) | 4.7” Retina | 12 MP | 64/128/256 GB | 5G, A15 Bionic, compact |

| iPhone 14 series (2022) | 6.1”-6.7” | Dual/Triple 12/48MP | 128/256/512/1TB | Satellite SOS, Dynamic Island (Pro models) |

| iPhone 15 series (2023) | 6.1”-6.7” | 48MP/Telephoto | 128/256/512/1TB | USB-C, AI features, titanium Pro models |

| iPhone 16 series (2024) | 6.1”-6.9” | Triple 48MP | 256/512GB/1TB | AI integration, larger screens, stacked quantum dot |

| iPhone 16e (2025) | 6.1” | Dual 12MP | 128/256/512GB | Affordable revamp, C1 modem, AI |

| iPhone 17/Air/Pro/Pro Max (2025) | 6.3”/6.7” | 48MP Multi | 256/512GB/1TB | A19 chip, super thin Air, new form factors, Center Stage camera |

Further technical specifications (RAM, SoCs, and more) are available in extended technical tables.

2.2 Innovation Highlights by Era

2007–2011: Foundational Years

The original iPhone upended the paradigm by merging a phone, iPod, and internet device with a multi-touch interface. The introduction of the App Store in 2008 transformed the device into a developer platform, spawning entire industries in mobile apps. The iPhone 4’s Retina Display (2010) redefined display sharpness, while the iPhone 4S brought voice-activated Siri and a new gold standard for smartphone cameras.

2012–2016: Material and Interface Changes

The iPhone 5 series introduced a slimmer, aluminum build and the Lightning connector. Later generations—iPhone 6 and 6 Plus—ushered in larger displays, NFC-based Apple Pay, and advanced camera features. Innovations like Touch ID brought biometric security mainstream, while 3D Touch on the 6s models added pressure-sensitive interactivity. Apple boldly removed the headphone jack in iPhone 7, driving wireless audio forward(despite initial backlash).

2017–2020: The Modern iPhone

iPhone X signaled a major design leap, eliminating the Home button and introducing Face ID with advanced biometric facial recognition and OLED edge-to-edge displays. Pro-class photography and computational imaging—Night mode, Smart HDR, and triple cameras—became standard for flagship models. iPhones responded to trends in wireless charging, water resistance, and 5G connectivity by the iPhone 12 era.

2021–Present: AI, New Form Factors, and Sustainability

Recent models prioritize AI integration, on-device intelligence, enhanced sustainability with rising recycled material content, and even thinner builds (notably, the iPhone Air). The Pro models have driven high refresh rate displays (120Hz ProMotion), satellite messaging, Dynamic Island UI, and, from 2023, universal USB-C ports. The introduction of highly differentiated models such as the iPhone 16e demonstrates Apple’s renewed focus on budget-conscious consumers and emerging markets.

3. Major Challenges and Hurdles in iPhone Development and Marketing

Apple’s iPhone journey, while enormously successful, has faced market, technical, supply chain, legal, and social obstacles.

3.1 Manufacturing and Supply Chain Challenges

Apple’s vast, just-in-time supply chain—masterfully orchestrated by Tim Cook—has been a key source of competitive advantage. However, about half of Apple’s suppliers are based in China, exposing the company to geopolitical tensions, tarrif risks, and pandemic disruptions. The COVID-19 crisis in 2020 forced major assembly plants like Foxconn’s Zhengzhou facility into shutdown, leading to considerable inventory delays, lost sales, and downstream frustration for global customers.

Recent years have seen Apple actively diversifying production to India and Southeast Asia and reinforcing relationships with its 300 top suppliers, many of whom are now shifting to renewable energy per Apple’s environmental guidelines.

3.2 Legal, Regulatory, and Antitrust Hurdles

Apple’s market dominance and vertically integrated model have repeatedly attracted regulatory scrutiny:

- Patent Wars with Samsung: From 2011, Apple and Samsung were embroiled in a “smartphone patent war” across dozens of countries. The dispute focused on both design and utility patents (rounded rectangles, app grids, bounce-back effects), resulting in billions in awards, multiple appeals, and a recalibration of global design patent law. Ultimately, courts reduced Apple’s winnings and both companies settled in 2018, but the case reshaped smartphone innovation and competitive caution.

- Antitrust Litigation: Apple’s App Store policies have triggered multiple lawsuits and regulatory probes in the EU (via the Digital Markets Act), United States (Justice Department and states’ antitrust lawsuits), and several international jurisdictions, forcing Apple to adjust default app settings, payment systems, and developer commission structures.

- Trademark and Local Disputes: Apple faced legal challenges in key markets (e.g., trademark issues in Mexico, Brazil, the Philippines), sometimes requiring compromises on the “iPhone” brand or adjustments in local marketing strategies.

- Other Regulatory Challenges: E-waste and recycling rules, right-to-repair mandates, and environmental reporting standards have forced Apple to incrementally open up repairability and part configurations, as seen with Repair Assistant and the expansion of authorized repair networks.

3.3 Technical Bumps and Controversies

Some of Apple’s most public hurdles were hardware or software missteps:

- Antennagate (iPhone 4): The infamous 2010 “death grip” controversy saw iPhone 4 signal strength drop when the device was held a certain way. Retrospective code analysis revealed a software bug in the signal bar display magnified the actual issue, ultimately costing Apple over $175 million in free bumper cases and settlements.

- Battery “Throttlegate”: Apple admitted in 2017 to intentionally slowing down older iPhones to accommodate aging lithium-ion batteries—a move meant for stability, but widely interpreted as “planned obsolescence.” It prompted fines and new transparency requirements for battery health and user-controlled throttle settings.

3.4 Marketing and Competition

Apple’s “Think Different,” “Shot on iPhone,” and minimalistic product campaigns have become case studies in marketing. Yet, increasing pressure from Samsung, Xiaomi, Google, and regional challengers (e.g., India and China) has forced Apple to adapt its strategies:

- Samsung’s rise, including its Galaxy Z Fold line, now threatens Apple’s innovation lead in foldables and AI, with Samsung overtaking Apple in Q2 2025 for global smartphone market share.

- Apple has had to respond with both broader product affordability (e.g., the iPhone SE line, iPhone 16e) and bolder features at the high end.

- Periods of “feature stagnation”—where new models are seen as only incremental upgrades—have led to longer iPhone upgrade cycles among consumers, challenging Apple to drive more frequent device turnover.

- In emerging markets, particularly India, local competition and aspirational but price-sensitive consumers have been a delicate balancing act. Apple has invested heavily in regional production and tailored offerings.

3.5 Social, Labor, and Internal Cultural Issues

- Rising employee activism (e.g., unionization campaigns in U.S. retail stores, #AppleToo movement) and high-profile allegations of gender and labor discrimination have prompted both media scrutiny and formal action by the U.S. National Labor Relations Board.

- Apple faces ongoing litigation, public pressure for workplace reform, and regulatory compliance demands on issues ranging from labor representation to social responsibility policies.

4. Global Market Position of Apple and the iPhone

Apple’s iPhone has been a market leader in both innovation and financial performance, shaping the competitive landscape and global consumer behaviors.

4.1 Global Smartphone Market Share

As of Q3 2025, Apple and Samsung remain locked as the two leading global smartphone vendors:

| Vendor | Q3 2025 Shipments (M) | Market Share (%) |

|---|---|---|

| Samsung | 61.4 | 19.0 |

| Apple | 58.6 | 18.2 |

| Xiaomi | 43.5 | 13.5 |

| Others | — | — |

While Samsung marginally leads in global volume, Apple secures disproportionate value share and profitability due to its premium price points and high ASPs (averaging $897 globally in 2025).

- In India (Q3 2025): Apple entered the top-5 by volume (9% share), but led the market in value (28% share).

- In the U.S.: Apple holds 51–59% market share, consistently dominating higher-value segments, with iPhones accounting for over half of all smartphones sold.

- In Japan and Australia: iPhone’s share exceeds 50%, peaking above 66% in Japan—reflecting high adoption among youth and urban consumers.

Apple’s global installed base reached 1.5 billion active iPhones in 2025.

4.2 Competitive Landscape

Apple’s principal global rival remains Samsung, whose product breadth—from entry-level to flagship foldables—gives it the edge in volume, particularly in emerging markets. However, Apple maintains a powerful “ecosystem lock-in” through the seamless integration of its iOS devices, services, and accessory products, leading to industry-best retention rates and high customer lifetime value.

In Europe and Greater China, Apple faces strong competition from Xiaomi, Oppo, vivo, and Huawei, who often undercut on price and match innovation pace.

- India: Apple’s share was long limited by pricing, tariffs, and Android’s dominance but has grown sharply due to local manufacturing, expanding retail footprints, and the introduction of locally appealing models (e.g., iPhone 15, 16e), as well as tailored financing/trade-in offers.

- China: Apple’s position has recently softened as Chinese OEMs rally with AI-driven features and competitive flagships.

4.3 The Apple Ecosystem Effect

Apple’s market position is more than just unit sales. Its tightly integrated ecosystem—comprising hardware (iPhone, iPad, Mac, Apple Watch, AirPods), software (iOS, macOS, etc.), and services (iCloud, Apple Music, App Store, Apple TV+, Fitness+)—delivers a sticky, seamless experience that sets it apart from less-integrated competitors.

- 78% of iPhone owners possess at least one other Apple device.

- Apple’s services business (App Store, iCloud, media, etc.) has swelled to 24% of company revenue, reflecting its shift towards recurring income streams and customer lock-in.

5. Detailed Sales Report: iPhone Units Sold and Revenue

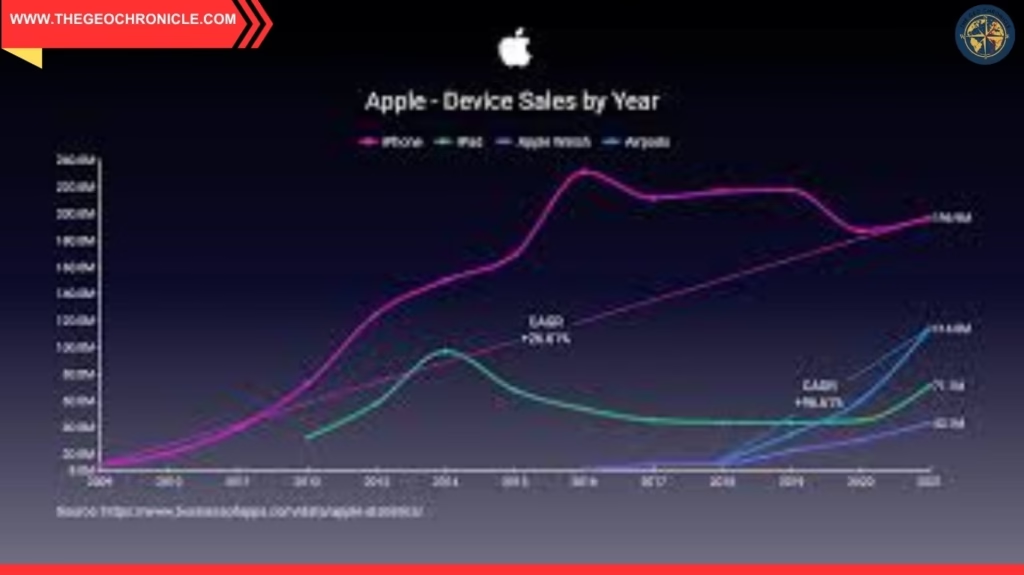

5.1 iPhone Global Units Shipped Annually

| Year | Units Sold (Million) | Revenue (USD, Billion) |

|---|---|---|

| 2007 | 1.39 | 0.123 |

| 2008 | 11.63 | 1.8 |

| 2009 | 20.73 | 13.0 |

| 2010 | 39.99 | 25.2 |

| 2011 | 72.29 | 46.0 |

| 2012 | 125.05 | 78.7 |

| 2013 | 150.26 | 91.3 |

| 2014 | 169.22 | 101.99 |

| 2015 | 231.22 | 155.0 |

| 2016 | 211.88 | 136.7 |

| 2017 | 216.76 | 141.3 |

| 2018 | 217.72 | 166.3 |

| 2019 | 190.60 | 142.4 |

| 2020 | 206.10 | 137.8 |

| 2021 | 233.90 | 191.9 |

| 2022 | 225.30 | 205.5 |

| 2023 | 231.80 | 200.6 |

| 2024 | 232.10 (proj.) | 201.2 |

| 2025 | 237.0 (est., Q3) | 212.4 (YTD) |

- Total iPhones sold (cumulative, 2025): Over 2.6 billion units.

- Active iPhone user base: 1.5 billion+ in 2024-2025.

- Geographic breakdown: U.S. (~57% market share), Japan (~66%), India (rapidly rising, now 8.2%), Europe (~31%), China (18.7%).

5.2 iPhone Revenue Share and Profitability

- iPhone comprises over 52% of Apple’s total company revenue in 2024-2025.

- Apple’s total FY2025 revenue: $416 billion (Q4 2025 report).

- Net sales by region:

- Americas: $167B

- Europe: $101.3B

- Greater China: $67B

- Japan: $25B

- Rest of Asia Pac: $30.7B.

5.3 Current Top-Selling Models

- iPhone 15 Pro Max: ~28% of 2025 sales share

- iPhone 14: 21.2%

- iPhone SE (3rd Gen): 12% YoY sales growth (continuing to attract value buyers)

- iPhone 13: 10.7% of userbase(still heavily used, especially in secondary markets).

5.4 Market Share and Life Cycle Data

- Global ASP (Average Sales Price): $897 in 2025, up from $867 in 2024

- U.S. ASP: $1,031; Europe: $924; India: $652

- Upgrade cycle length: 3.2 years (U.S.), 2.7 years (Japan)

- Retention rate: 92% (U.S.), with high levels of “ecosystem lock-in”

6. Future Growth Prospects and Strategic Directions

Apple faces a crossroads: to maintain its dominance amid slowing global smartphone growth, fierce competition, and new technology demands. Its future prospects are informed by several pillars.

6.1 AI and Apple Intelligence

Unveiled at WWDC 2024, Apple Intelligence promises to bring a new suite of generative AI features tightly integrated with on-device Apple Silicon, starting with the iPhone 15 Pro (iOS 18). This technology seeks to set Apple apart from competitors by prioritizing privacy and blending generative and personalized user experience. Siri’s overhaul is set to enable multi-step, complex queries with real-time responsiveness.

6.2 Emerging Form Factors

- Foldables: Apple is widely reported to be developing a foldable iPhone (“iPhone Fold”), intended to rival Samsung’s Z Fold series. Rumored for a 2026 launch, the iPhone Fold will likely feature a book-style mechanism, titanium chassis, new hinge technology, and high price (est. $1,800–$2,500). This marks Apple’s emergence into the next major mobile form factor.

- Augmented Reality: The Vision Pro AR headset signifies Apple’s investment in AR/VR. Lightweight AR glasses and smart lens projects, rumored for 2026 and beyond, could yield their own ecosystem effects, further merging Apple’s mobile and spatial computing efforts.

6.3 Expansion in Emerging Markets

India is at the forefront of Apple’s international expansion, both as a production hub and as one of the fastest-growing iPhone markets. Apple is scaling local manufacturing (now producing 25% of its iPhones in India), investing in retail presence, and launching products tailored to the aspirations and affordability of Indian buyers, as evidenced by the iPhone 16e and trade-in options. These moves foreshadow Apple’s broader global expansion, with Southeast Asia and the Middle East also in focus.

6.4 Services and Recurring Revenue

Apple’s strategic tilt toward services is yielding strong results. Services now comprise nearly a quarter of Apple’s revenue, including the App Store, iCloud, Apple Music, Apple TV+, and emerging health/fitness offerings. Recurring subscription revenue and engagement in Apple’s ecosystem will remain a core focus for future growth.

6.5 Chip Innovation and Custom Silicon

Apple’s investment in custom silicon remains a critical differentiator. The latest A18/A19 chips and the C1/C2 cellular modems are designed in-house, with further integration expected across device lines. Custom AI acceleration, energy efficiency, and performance boosts are expected to reinforce Apple’s premium position.

6.6 ESG, Sustainability, and Repairability

Apple has committed to achieving carbon neutrality for its entire footprint—including supply chains and user energy by 2030. Noteworthy milestones (as of FY2025):

- Over 60% emissions reduction since 2015

- 24% of materials in 2024 from recycled or renewable sources; 99% recycled rare earths in all magnets

- Aggressive targets to use 100% recycled cobalt, tin, gold, and rare earths in all products by end of 2025

- All iPhone packaging: 100% fiber-based and plastic-free

- Enhanced repairability (Repair Assistant, battery and part access improvements)

- Daisy robot: dismantling over 36 iPhone models for recycling

These advances win favor with conscious consumers and regulators, and increasingly act as requirements in procurement for large corporate and institutional customers.

7. Apple’s Strategic Directions, Risks, and Future Outlook

7.1 Strategic Risks

- Market Competition: Intensifying global rivalry, especially from Samsung and Chinese OEMs, along with shifts in consumer upgrade behavior, pose constant threats to volume and market share.

- Geopolitical/Regulatory Risk: Heavy reliance on China for manufacturing exposes Apple to trade wars and political instability; regulatory and antitrust risks continue to grow, especially in the U.S. and EU.

- AI Innovation Pace: If Apple lags in AI compared to open platforms like Google’s Gemini (especially as Samsung pushes its advantage), it risks attrition of high-value, tech-savvy users.

- Supply Chain Fragility: Global disruptions, as experienced during the pandemic, can significantly impact inventory and availability, risking customer loyalty.

7.2 Long-term Outlook

Despite these risks, Apple’s financial position is strong, with a $140.8 billion liquidity buffer (as of September 2024), robust margins, and consistent innovation pipeline. The expansion of its ecosystem, push into services, and investments in AI and sustainability will likely underpin the next wave of growth. The pending foray into foldables and spatial computing could significantly refresh the product cycle for both early adopters and mainstream users.

8. Apple iPhone and Ecosystem: Sustainability and Social Impact

Sustainability has become central to Apple’s mission. Notable outcomes:

- Carbon neutral targets for 2030, with current net emissions 60% lower than in 2015.

- Over 19 million users globally have participated in Apple’s trade-in and recycling programs.

- Major shift toward repairability, recycled content, and more transparent supply chains.

- Commitment to workplace diversity, labor rights, and inclusivity remains in the spotlight, with Apple responding to both internal and external pressures for reform.

Disclaimer

This report is based on publicly available information from a wide range of authoritative sources, historical data, news analysis, and official Apple releases. All figures, trends, and forecasts herein are subject to change as new information emerges. This article does not constitute financial investment advice or official Apple Inc. documentation.

Leave a Reply