Nokia, a name synonymous with mobile phones for several decades, stands today as an emblem of both extraordinary industrial achievement and sobering lessons in corporate reinvention. From humble beginnings as a Finnish paper mill in the 19th century to global dominance in the telecommunications field, and finally its transformation into a cutting-edge B2B technology and 5G infrastructure leader, the history of Nokia Company is a rich tapestry of technological innovation, strategic pivots, and hard-won adaptation. This long-form article offers a comprehensive examination of Nokia’s journey, delving into its origins, rise to becoming a mobile titan, celebrated milestones, painful decline, and remarkable reinvention as a vanguard of network infrastructure and 5G solutions. The story of Nokia is not only about technological evolution but about resilience and timely strategic change—making it particularly relevant for business leaders and technology enthusiasts alike.

Founding and Early Operations in Finland

The roots of Nokia trace back to 1865, marking its inception as a single paper mill established by mining engineer Fredrik Idestam in the town of Tampere, then under the Russian Empire. Recognizing the hydropower potential, Idestam set up a second mill near the Nokianvirta River in 1868, whose name later inspired the company’s branding. By 1871, in partnership with financier and statesman Leo Mechelin, Idestam transformed his enterprise into a public limited company, Nokia Ab, further setting the foundation for what would become a future powerhouse in technology.

During the late 19th and early 20th centuries, Nokia expanded gradually, first venturing into electricity generation in 1902 and building a legacy of adaptability early on. However, it was not until the formation of Suomen Gummitehdas Oy (Finnish Rubber Works Ltd) in 1898 and Suomen Kaapelitehdas Oy (Finnish Cable Works Ltd) in 1912—both enterprises eventually merged into Nokia—that the company truly diversified its industrial interests. These early decades were marked by the strategic leveraging of the region’s industrial capacity, positioning Nokia at the heart of Finland’s economic development.

The unique climate of cooperation among Nordic countries also contributed to Nokia’s success, particularly as these nations collectively prioritized mobile technology due to their sparse populations and harsh terrains—a prelude to Finland’s leadership in telecommunications decades later.

Expansion into Rubber, Cables, and the 1967 Merger

Nokia’s transformation into a multifaceted industrial operation was propelled by a series of mergers and strategic alliances throughout the first half of the 20th century. The most pivotal event occurred in 1967 when three independent companies—Nokia Ab, Finnish Rubber Works, and Finnish Cable Works—amalgamated to form the modern Nokia Corporation. This merger unified expertise in paper, rubber, and electrical cables, equipping the new entity to compete in a rapidly diversifying industrial environment.

By this time, the group’s product spectrum had expanded to include not just cables and rubber boots but also car and bicycle tires, forestry and power generation products, plastics, electronics, and even consumer appliances such as televisions. Supremely adaptable, Nokia produced items as diverse as industrial robots, plastics, military technology, and aluminum products, setting a precedent for the flexibility that would later become vital to its survival. Notably, the heritage from Finnish Rubber Works and Cable Works resides today in independent companies such as Nokian Tyres and Nokian Footwear, both industry leaders in their own right.

Entry into Electronics and Network Equipment

Electronics Initiatives and Early Innovation

Nokia’s entry into electronics did not follow a linear path but was instead characterized by a willingness to experiment at the margins of its core competencies. Its electronics division, established officially in 1967, spent the next fifteen years oscillating between profitability and loss but cultivated a pioneering ethos. By encouraging researchers to pursue independent projects, Nokia laid the groundwork for two of its key contributions to global telecommunications: mobile devices and digital switching infrastructure.

The first major digital innovation emerged in the early 1980s with the launch of the Nokia DX 200 digital telephone switch. This platform, featuring modular hardware and sophisticated software architectures, revolutionized Finland’s telecommunications landscape, greatly boosting the reliability, automation, and scalability of exchange equipment. It soon became the workhorse for the division and positioned Nokia to adapt swiftly as telecom infrastructure technology advanced.

Network Equipment and Early Mobile Telephony

Throughout the 1970s and 1980s, Nokia made considerable progress in communications networks, notably merging its equipment division with state entities to benefit from favorable government policies. The pioneering Nokia DX 200 system not only facilitated the growth of the domestic market for digital telephone exchanges but became a critical export product, with installations not only in Finland but also in China, Nepal, the UAE, Sri Lanka, and the Soviet Union. The modular design enabled upgrades and flexibility, while the system’s reliability became legendary—it was often cited as exceeding five nines (99.999%) availability.

Nokia was also involved in early mobile radio telephony, developing commercial and military-grade radios, leading up to the foundation of Mobira Oy, a joint venture with Salora in 1979, which would build the path to future mobile dominance.

Rise as a Global Telecommunications Leader and GSM Development

Mobile Phone Evolution: 1G and 2G Milestones

By the late 1970s and 1980s, Nokia had positioned itself at the forefront of mobile technology. After acquiring Salora and full control of Mobira, Nokia debuted a succession of groundbreaking devices:

- Mobira Senator (1982): The company’s first car phone for the NMT–450 network, weighing 10 kg.

- Mobira Cityman 900 (1987): Its first true handheld mobile phone, famously used by Soviet leader Mikhail Gorbachev, highlighting the increasing social currency of portable telephony.

In the 1980s, Nokia also contributed significantly to the design and roll-out of the Nordic Mobile Telephone (NMT) network, the world’s first fully automatic cellular system, which made national and international roaming possible.

GSM and the 2G Revolution

Perhaps Nokia’s most lasting legacy in telecommunications is its integral role in developing the GSM (Global System for Mobile Communications) standard, which defined digital cellular communications for the world. The first GSM call was made on a Nokia device in Helsinki in 1991 by Finnish Prime Minister Harri Holkeri—a symbolic moment that ushered in a new era of mobile voice and data services. Nokia produced the first mass-market GSM phone, the Nokia 1011, launched in November 1992, and quickly became the backbone provider of GSM infrastructure in Europe and beyond.

Key Innovations in this period:

- Nokia 1011 (1992): First mass-produced GSM mobile phone.

- Early data services: Enabled SMS text messaging, eventually leading to MMS and mobile internet.

- GSM networks: Rapidly adopted worldwide, by 2008 there were over 3 billion GSM users, supported by Nokia infrastructure and handsets.

Mobile Phone Market Dominance in the Feature Phone Era

Explosive Growth and Iconic Products

The late 1990s and early 2000s marked the zenith of Nokia’s market dominance. Under CEO Jorma Ollila, Nokia focused exclusively on telecommunications, divesting its other business lines. With an innovation-centered strategy and streamlined global production, the company captured and held over 40% of the world’s mobile phone market at its peak.

Best-selling Models and Cultural Impact:

- Nokia 5110 and 3210 (late 1990s): Known for their easy operation, affordability, and customizable covers.

- Nokia 3310 (2000): Became one of the best-selling devices in history, celebrated for its durability, long battery life, and addictive pass-time game Snake.

- Nokia 1100 (2003): The best-selling phone of all time, with over 250 million units sold; popular in both developed and emerging markets for its simplicity and reliability.

Nokia’s feature phones set global trends in usability, reliability, and design, introducing innovations such as:

- Replaceable faceplates

- T9 predictive text

- Robust hardware and legendary battery longevity

- Built-in games and ringtones (notably the “Nokia tune”)

Nokia’s Major Product Timeline (1982-2010)

| Year | Product/Series | Notable Innovation/Impact |

|---|---|---|

| 1982 | Mobira Senator | First car phone for NMT-450 network |

| 1987 | Mobira Cityman 900 | First handheld mobile phone |

| 1992 | Nokia 1011 | First mass-produced GSM phone |

| 1994 | Nokia 2100 | Debut of iconic “Nokia tune” ringtone |

| 1998 | Nokia 5110 | Replaceable faceplates, Snake game |

| 1999 | Nokia 3210 | Internal antenna, youth appeal |

| 2000 | Nokia 3310 | Most iconic, robust phone, legendary battery |

| 2002 | Nokia 7650 | First Nokia phone with a built-in camera |

| 2003 | Nokia 1100 | Best-selling phone in history |

| 2007 | Nokia N95 | Multimedia flagship: GPS, Wi-Fi, 5MP camera |

| 2008 | Nokia 5800 XpressMusic | First consumer touchscreen device |

The innovation in hardware and user interface, combined with a robust supply chain and global marketing reach, enabled Nokia to dominate developed and emerging markets alike.

Early Smartphones: Symbian, N & E Series

Nokia did not ignore smartphones, releasing a string of successful devices powered by the Symbian OS. The Communicator series (e.g., 9000, 9110), N-series (N95, N97), and E-series (E71, E52) were ahead of their time in integrating email, web browsing, multimedia, and productivity features for business and consumer users.

However, Symbian lacked the fluid experience and developer ecosystem that Apple and Google would establish, a gap that proved critical later on.

Partnership with Microsoft and the Windows Phone Transition

Challenging Times and the “Burning Platform” Memo

By the mid-2000s, stiff competition emerged from Apple’s iPhone and Android platform. Nokia’s response was slow, clinging to Symbian for too long and failing to invest heavily enough in touch-based UI and developer-friendly systems. As iOS and Android redefined user expectations and app ecosystems, Nokia’s market share began to slip precipitously. The leadership responded with repeated but partial restructuring efforts, unable to build momentum behind either Symbian’s modernization or alternative platforms like MeeGo.

When Stephen Elop, a former Microsoft executive, became CEO in 2010, he famously described Nokia’s predicament as a “burning platform,” highlighting the urgent need for radical change. This memo initiated a turning point for the company.

The Microsoft Partnership

In February 2011, Nokia and Microsoft unveiled a broad strategic partnership: Nokia would adopt Windows Phone as its principal smartphone platform, aiming to build a third mobile ecosystem capable of rivaling iOS and Android.

Key elements of the partnership included:

- Nokia’s expertise in hardware integrated with Microsoft’s software, Bing search, and AdCenter advertising.

- Nokia Maps technology was integrated into Microsoft services and Bing.

- Joint marketing and product development.

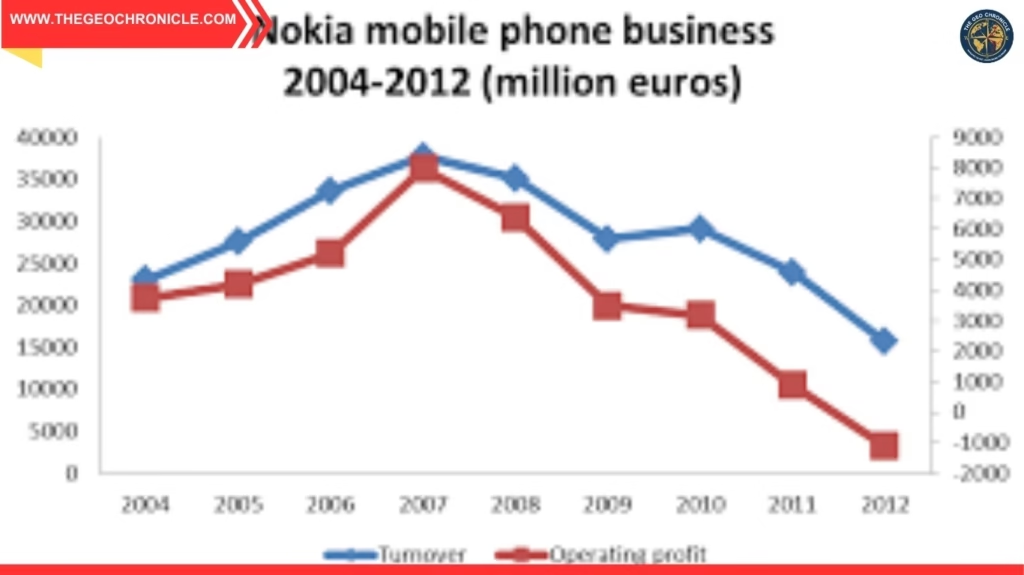

Initial launches included the Lumia 710 and Lumia 800, followed by the flagship Lumia 920. Nokia poured resources into producing distinctive hardware, such as PureView imaging, wireless charging, and colorful polycarbonate bodies. However, Windows Phone struggled to woo both consumers and developers. Nokia’s smartphone sales, which had dominated the industry into the late 2000s, fell dramatically: by 2013, its global market share had shrunk to less than 5%.

Nokia Smartphone Platform Timeline (2002–2014)

| Period | Platform | Strategic Direction | Outcome |

|---|---|---|---|

| 2002–2010 | Symbian OS | Incremental innovation; tried to unify UI; significant fragmentation | Declining market share post-2007 |

| 2009–2011 | Maemo/MeeGo (with Intel) | Linux-based, open; high potential but internal conflict, slow launch | Cancelled/N9 limited release |

| 2011–2014 | Windows Phone (partnership with Microsoft) | Strategic pivot, exclusive partnership with Microsoft, focus on UI and camera innovation | Failed to gain traction, led to business sale |

Decline in Market Share and Smartphone Disruption

Multilayered Causes of Decline

Nokia’s fall from mobile dominance is often attributed to external disruption from Apple and Google. While true, internal factors amplified the crisis:

- Resistance to Change: Nokia overestimated the resilience of its feature phone business, underestimating the significance of the smartphone revolution.

- Software Platform Woes: The decision to stick with Symbian long past its prime, muddled strategic debates between supporting Symbian, MeeGo, or moving to Android, and missteps with the Windows Phone transition.

- Organizational Turmoil: Frequent leadership reshuffles, ineffective matrix restructuring, and cultural inertia slowed decision making and innovation.

Factors in Nokia’s Decline

| Factor | Impact |

|---|---|

| Overreliance on Hardware | Under-invested in software, UI, and ecosystem |

| Slow Response to Smartphones | Missed the touch and app ecosystem revolution |

| Fragmented Software | Dozens of OS variants delayed updates, increased cost |

| Leadership Instability | Multiple CEO changes, strategic confusion |

| Strategic Partnerships | Windows Phone failed to catch up with iOS/Android |

| Delay in Embracing Android | Competitors like Samsung raced ahead |

As a result, Nokia’s once-thriving mobile business was sold to Microsoft for €3.79 billion in April 2014 (plus a €1.65 billion patent license).

What Went Wrong

Despite bold efforts, the Windows Phone ecosystem failed to attract both app developers and consumers in large enough numbers. The woes were compounded by incompatible product roadmaps, slow feature rollout, and persistent perception that Windows Phone lacked the dynamism and versatility of Android or iOS.

Microsoft’s acquisition of Nokia’s Devices and Services division likewise failed to revive the platform, and by 2016, Microsoft sold the Nokia-branded feature phone business to HMD Global and Foxconn, ending one of the most impactful eras in mobile history.

Strategic Reinvention and Focus on Network Infrastructure

Post-Mobile Phone Era: Back to B2B and Networks

While the sale of the mobile division marked the end of Nokia’s era as a global consumer brand powerhouse, it did not spell the company’s demise. On the contrary, Nokia used its robust intellectual property, deep experience in connectivity, and strong base in telecom equipment to reinvent itself as a leading B2B network technology provider.

Key Moves and Restructurings:

- Focused investment into Nokia Networks (the infrastructure business) and Nokia Technologies (research, patents, and licensing), both of which remained profitable and positioned for growth.

- Acquisition of Alcatel-Lucent and Bell Labs in 2016 for €15.6 billion, immediately making Nokia a top global player alongside Ericsson and Huawei.

Under the leadership of Rajeev Suri (CEO 2014–2020), Nokia executed a prudent, methodical strategy: cost controls, consolidation around network innovation (4G, LTE, 5G), and leveraging its substantial portfolio of over 29,000 patents. The shift proved successful—by 2025, Nokia boasts market-leading performance in several critical telecom technology categories and is considered essential for digital transformation initiatives worldwide.

Investment in R&D and Technology Licensing

Nokia continues to make substantial investments in research and development, guided by the award-winning Nokia Bell Labs, and generates significant revenue from technology licensing in the fields of VR, smart devices, and healthcare. Bell Labs, in particular, remains a symbol of advanced telecommunications research, contributing innovations to 5G, massive MIMO, photonic integrated circuits, and more.

Current 5G and Network Infrastructure Business

Market Leader in 5G, Cloud, and Network Solutions

In 2025, Nokia stands as one of the world’s top vendors for mobile and fixed network infrastructure, cloud-based solutions, and enterprise AI-driven networks. Recent recognitions include being named a Leader in the 2025 Gartner® Magic Quadrant™ for Communication Service Provider 5G Core Network Infrastructure Solutions, ranking highest in “completeness of vision” for the fifth consecutive year.

Business Group Breakdown:

- Network Infrastructure: Largest and fastest growing division; strong in optical, IP, fixed, and submarine networks. Q2 2025 net sales up 25%. Recent key customer wins among hyperscalers and data center expansions.

- Mobile Networks: Focuses on 5G radio and private wireless solutions. 2025 saw some headwinds from project timing and tariffs but stabilizing with key customer contracts.

- Cloud and Network Services: Leading in 5G core, network-as-a-service models, AI, and cloud-native analytics. Q2 2025 net sales grew 14%.

- Nokia Technologies: Technology licensing, patent monetization, and incubation of new business areas, generating €1.1bn+ operating profit in 2025.

With over 125 5G standalone core operator customers and the broadest active deployments at 54, Nokia remains a core enabler of global communications and the “AI supercycle”—supporting digital transformation not only in communications but also defense, energy, and critical infrastructure.

Recent Milestones in 5G and Cloud:

- Major hyperscaler agreements, such as the five-year expansion with Microsoft Azure to supply data center routers and switches in over 30 countries, highlight Nokia’s strength outside of traditional telco customers.

- Commercial launches of private wireless and industrial IoT solutions—addressing enterprise verticals like ports, manufacturing, and agriculture, enhancing digital resilience on a global scale.

- Innovations in AI, edge computing, and next-gen 6G R&D are driven by the new, technology-focused divisions created in 2025.

Nokia Group Financial Highlights (H1 2025)

| KPI (Group) | Q2 2025 | Q2 2024 | H1 2025 | H1 2024 | YoY Change |

|---|---|---|---|---|---|

| Net Sales (€ bn) | 4.55 | 4.47 | 8.94 | 8.91 | +2% |

| Gross Margin (%) | 44.7% | 44.7% | 43.5% | 47.6% | — |

| Operating Profit (€ million) | 301 | 423 | 457 | 1,023 | –29% (Q2) |

| Operating Margin (%) | 6.6% | 9.5% | 5.1% | 11.5% | — |

| Net Cash (€ bn) | 2.9 | 5.5 | 2.9 | 5.5 | –47% (Q2) |

| Dividend per Share (€) | 0.04 | 0.04 | 0.08 (total YTD) | 0.08 (YTD) | — |

Source: Nokia Group 2025 Q2 Financial Report

Leadership and Strategic Shifts

Nokia’s leadership has embraced transformation, with significant changes in 2025 including the arrival of new CEO Justin Hotard and the restructuring of the company into more agile, product-focused groups. Hotard emphasizes driving AI, security, and strategic partnerships. The company’s Capital Markets Day (November 2025) is expected to reveal a new AI- and security-infused enterprise strategy—extending Nokia’s offerings beyond telecom into defense, national security, and digital industry solutions.

Significant leadership changes have also occurred at the Group Leadership Team level, hinting at further innovation and a push into next-generation technology fields.

Financial Performance and Market Metrics

Robust Financials Amid Currency and Market Headwinds

Nokia’s 2025 financials show a resilient, diversified business with steady sales, high gross margins, and ongoing R&D investment. Despite some currency and macroeconomic pressures—including a sharply weakened USD and new tariff-related costs—the company is profitable, with a healthy cash position and strong outlook for high-margin technology licensing.

Selected 2025 Metrics:

- Full-year comparable operating profit outlook adjusted to €1.6–2.1 billion; free cash flow conversion 50–80% of profit.

- Dividend policy: €0.14 maximum per share, paid in quarterly installments.

- R&D expenditure remains robust at over €2.2bn per half year; technology spend concentrated in 5G, AI, and cloud infrastructure.

- Nokia employs over 70,000 people worldwide and remains one of Finland’s most recognized brands.

Global Market Share

Nokia is now among the top three global telecommunications infrastructure providers, competing directly with Huawei and Ericsson. Its market share in 5G, outside China, exceeds 20%, with a leading presence in private networks and industrial 5G deployments.

Competitive Landscape

| Company | Core Focus | 2025 Market Position | Notes |

|---|---|---|---|

| Nokia | Telecom network, 5G, cloud | Top 3 global; leader in 5G Core | 125+ operator customers; innovation leader |

| Ericsson | Telecom network, 5G, OSS/BSS | Top 3 global; leading US market | Strong in Managed Services, 5G RAN |

| Huawei | Telecom network, 5G, IoT | Global #1 by volume | Restricted in Western markets; R&D heavy |

Source: Omdia, Gartner, Company Reports

Leadership Changes and Corporate Governance

Evolving Leadership for Strategic Agility

Rapid change has marked Nokia’s leadership over the past fifteen years, reflecting the company’s ongoing need for strategic agility and new expertise. From visionary Jorma Ollila’s steerage in the 1990s to periods of instability in the 2000s, and onto Rajeev Suri’s consolidation and reinvention, each leader played a significant part in the company’s trajectory.

Most recently, the transition to CEO Justin Hotard in 2025 and the elevation of executives such as David Heard (Network Infrastructure, ex-Infinera) and Pallavi Mahajan (Chief Technology and AI Officer, ex-Intel) signify a clear intent to lead in AI-driven network solutions and digital infrastructure.

A summary of Nokia’s recent leadership highlights:

| CEO | Term | Strategic Focus |

|---|---|---|

| Jorma Ollila | 1992–2006 | Telecom transformation, mobile ascendency |

| Olli-Pekka Kallasvuo | 2006–2010 | Matrix reorg, late smartphone pivot |

| Stephen Elop | 2010–2014 | Windows Phone partnership, sale to Microsoft |

| Rajeev Suri | 2014–2020 | Network infrastructure, Alcatel-Lucent acquisition |

| Pekka Lundmark | 2020–2025 | Simplification, return to focus, 5G/AI pivot |

| Justin Hotard | 2025–present | AI-driven growth, unified corporate functions, innovation |

Source: Company Reports, News Announcements

Major Milestones and Product Timeline

| Year | Event / Product | Strategic/Technological Significance |

|---|---|---|

| 1865 | Paper mill founded (Fredrik Idestam) | Origin of Nokia; industrial legacy |

| 1967 | Nokia Corp. formed (merger) | Diversification, expansion |

| 1982 | Mobira Senator, DX200 switch | First car phone, digital exchange |

| 1991 | First GSM call, Nokia network | Set GSM global standard |

| 1992 | Nokia 1011 (first mass-market GSM phone) | Digital mobile revolution |

| 1998 | World’s #1 mobile phone maker | Market dominance |

| 2000 | Nokia 3310 | Best-selling, iconic feature phone |

| 2003 | Nokia 1100 | All-time best-selling phone |

| 2007 | Launch of N95, iPhone enters market | Smartphone race intensifies |

| 2011 | Microsoft partnership (Windows Phone) | Strategic smartphone pivot |

| 2014 | Sale of mobile business to Microsoft | End of mobile era |

| 2016 | Acquires Alcatel-Lucent / Bell Labs | Global network infrastructure leader |

| 2018 | Launch of ReefShark 5G chip | 5G network innovation |

| 2020 | 5G global deployments accelerate | Maintains global telecom leadership |

| 2025 | AI/6G R&D, strategic restructuring | Expands beyond telecom into enterprise |

Product, Technology, and Leadership Table

Selected Nokia Mobile Phones and Technologies Timeline

| Year | Model/Tech | Key Feature | Significance |

|---|---|---|---|

| 1982 | Mobira Senator | NMT 450 car phone | Mobile era begins |

| 1992 | Nokia 1011 | First mass-market GSM phone | Mobile revolution |

| 1998 | Nokia 5110 | Interchangeable covers, Snake game | Youth appeal, brand recognition |

| 2000 | Nokia 3310 | Durability, battery life, SMS | Cultural icon |

| 2002 | Nokia 7650 | Built-in camera, S60 platform | Smartphone innovation |

| 2005 | N91/N70 | Music/camera-centric phones | Multimedia leadership |

| 2007 | N95 | GPS, Wi-Fi, 5MP camera | Competed with iPhone early on |

| 2011 | Lumia 800 | First Windows Phone Nokia device | Partnership with Microsoft begins |

| 2013 | Lumia 1020 | 41MP PureView camera | Imaging excellence |

| 2017 | Nokia 6 (HMD) | Android-powered revival | Brand nostalgia, Android adoption |

| 2022 | ReefShark chip | AI, energy-efficient 5G hardware | Cost and performance leadership |

Current Strategic Focus and Future Prospects

Nokia’s current focus rests squarely on providing the technological backbone for AI-powered societies. The company is extending its reach well beyond the telecom carrier sector into new verticals—public safety, defense, industrial automation, and smart infrastructure—riding on a wave of 5G and, soon, 6G opportunities.

2025 Outlook and Strategy

- Unified, agile organizational structure to accelerate AI, cybersecurity, and advanced networking solutions.

- Strategic partnerships with hyperscalers and new industries, such as Microsoft Azure, to drive non-telco growth.

- R&D investment concentrated on edge AI, sustainability (energy efficiency), and next-generation digital twins.

- Expansion into government, defense, and regulated environments.

Investor sentiment remains cautiously optimistic, with Nokia viewed as a critical component in supporting future digital economies, even as the broader telecoms infrastructure market undergoes rapid change.

Conclusion

Nokia’s story is one of persistent adaptation, innovation, and resilience. It is at once a case study in the perils of technology disruption and a testament to the power of strategic reinvention. From a Finnish paper mill to the world’s mobile phone giant, and through a painful but instructive fall, Nokia has emerged once again as a global enabler of technological progress through its premium infrastructure and 5G solutions.

Its legacy endures not just in products but in the DNA of continuous innovation and corporate resilience—a lesson both for emerging tech companies and enduring industrial stalwarts alike. As the company looks forward to an AI- and 6G-powered future, Nokia’s unique ability to transform in the face of adversity seems assured.

Disclaimer

This report is provided for informational purposes only. Financial figures, product examples, and historical context are based on public disclosures, official company statements, and widely cited reputable analyses as of late 2025. The information does not represent investment advice or predictive guidance. Readers are encouraged to conduct independent research or consult professional advisors for specific business or investment decisions.

Leave a Reply